Effortless AR Recovery

for Small Businesses

Don't let a debt collection agency ruin your relationships with your customers. We use AI to gently manage Accounts Receivable from Day 31 onwards.

Don't let a debt collection agency ruin your relationships with your customers. We use AI to gently manage Accounts Receivable from Day 31 onwards.

Full service AR support - From dunning to collections

Gentle and consistent support from Day 31 onwards

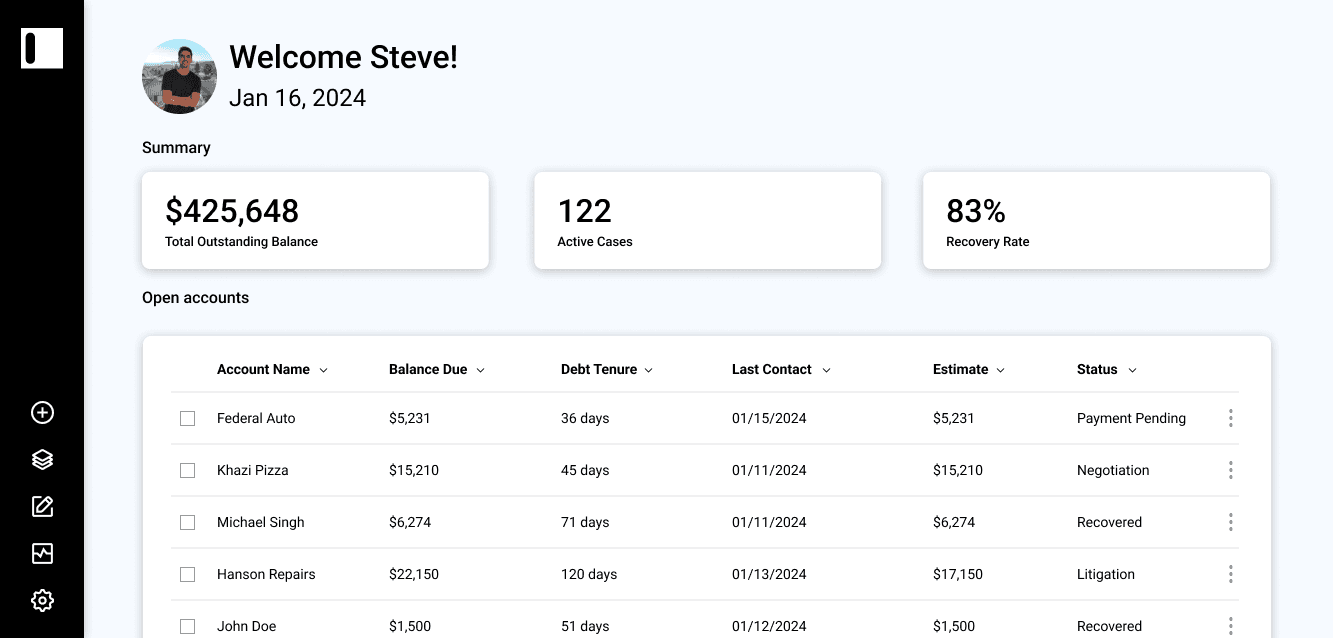

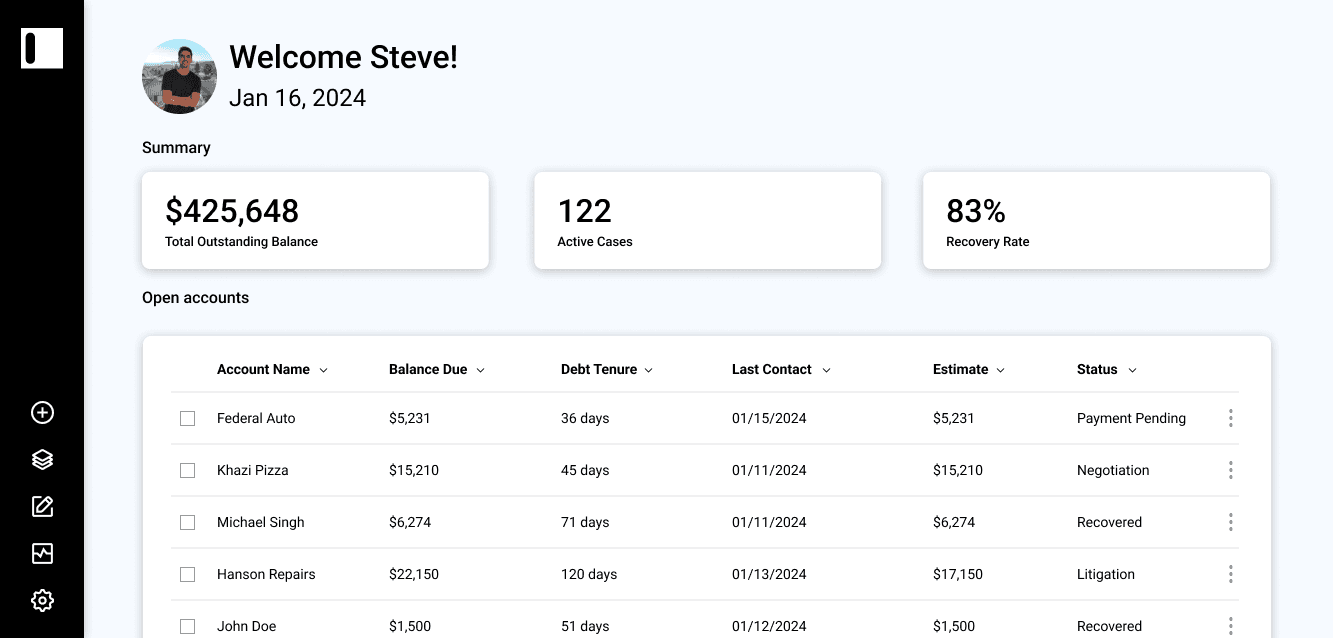

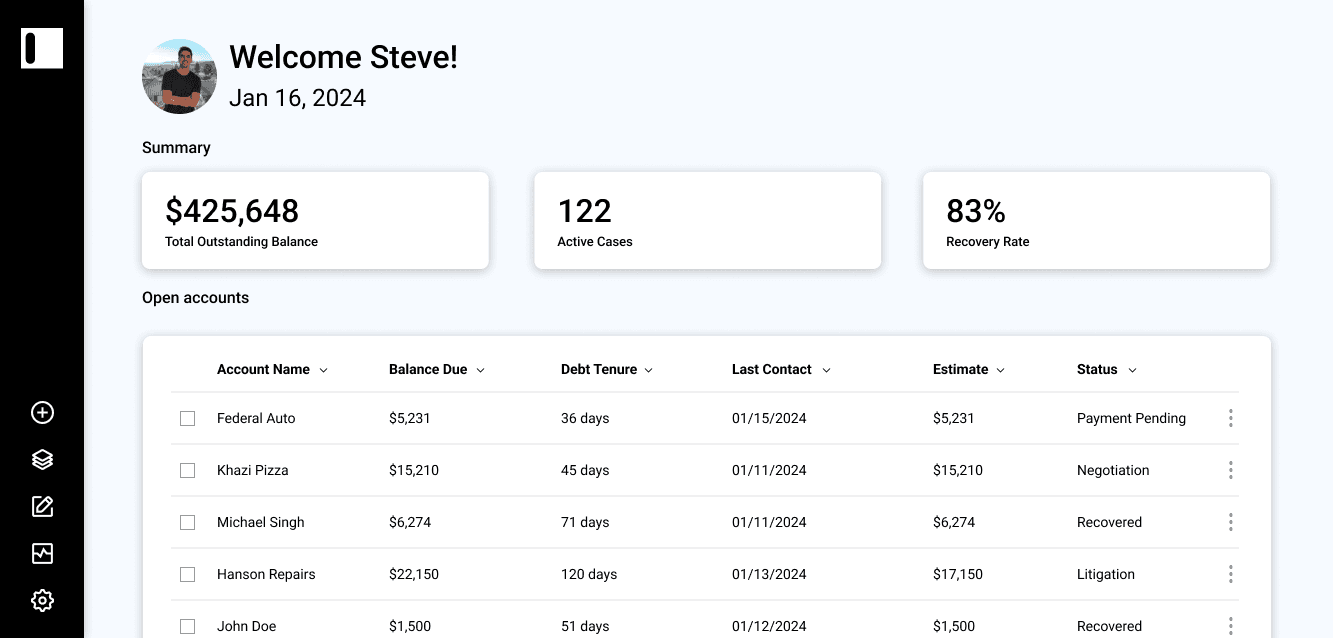

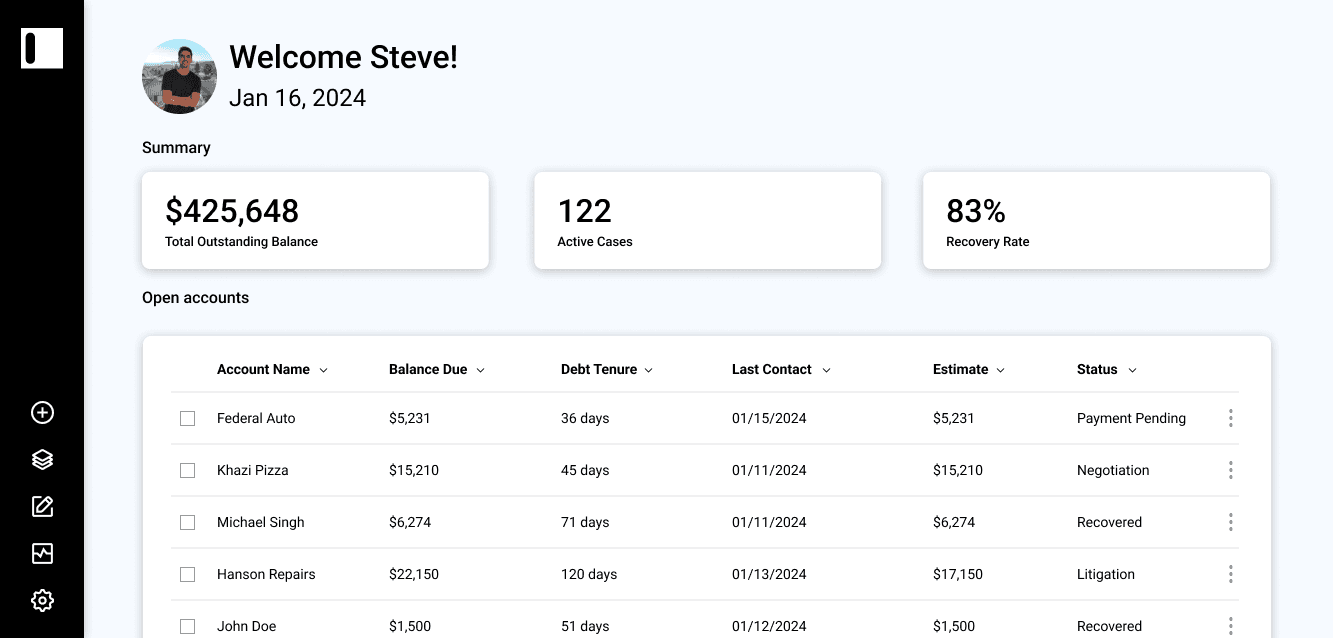

Accessible dashboard for quick & easy overview

AR collection for the 21st century - Native AI tooling

AR collection for the 21st century - Native AI tooling

Generic reminder emails rarely work and collections agencies are aggressive. We've developed a tactical tool for the 21st century that combines dynamic dunning from Day 31 with advanced collections for more mature balances.

Generic reminder emails rarely work and collections agencies are aggressive. We've developed a tactical tool for the 21st century that combines dynamic dunning from Day 31 with advanced collections for more mature balances.

Dunning sequences tailored by industry, account type and timeline

Dunning sequences tailored by industry, account type and timeline

Dunning sequences tailored by industry, account type and timeline

Dunning sequences tailored by industry, account type and timeline

AI response automation to manage large account classes

AI response automation to manage large account classes

AI response automation to manage large account classes

AI response automation to manage large account classes

Recovery estimates and dashboards for account management

Recovery estimates and dashboards for account management

Recovery estimates and dashboards for account management

Recovery estimates and dashboards for account management

Compliant and debtor friendly collections

Compliant and debtor friendly collections

Debt collection agencies are notorious for ruining customer relationships and hurting your brand. All of our processes go through strict compliance with Fair Debt Collection Practices Act and are designed to gently bring accounts to debt free with reasonable negotiation.

Debt collection agencies are notorious for ruining customer relationships and hurting your brand. All of our processes go through strict compliance with Fair Debt Collection Practices Act and are designed to gently bring accounts to debt free with reasonable negotiation.

Strict compliance with Fair Debt Collection Practices Act

Strict compliance with Fair Debt Collection Practices Act

Strict compliance with Fair Debt Collection Practices Act

Strict compliance with Fair Debt Collection Practices Act

Gentle but tactical reminders that rarely escalate into legal action

Gentle but tactical reminders that rarely escalate into legal action

Gentle but tactical reminders that rarely escalate into legal action

Gentle but tactical reminders that rarely escalate into legal action

Start at Day 31 to minimize risk of escalation

Start at Day 31 to minimize risk of escalation

Start at Day 31 to minimize risk of escalation

Start at Day 31 to minimize risk of escalation

Simple steps to get started

Simple steps to get started

Getting started with Almaq is as simple as setting up a new email client.

Getting started with Almaq is as simple as setting up a new email client.

Getting started with Almaq is as simple as setting up a new email client.

Getting started with Almaq is as simple as setting up a new email client.

Discovery call with our sales team

Let's determine if Almaq is the right fit for your accounting team.

Provide CSV of outstanding balances

Choose a collections strategy

Say goodbye to writing off late payments

Gentle AR recovery that maintains your brand and eliminates cash flow issues requires a modern solution. Try Almaq today.

© Copyright 2024, All Rights Reserved by Almaq, Inc.

Say goodbye to writing off late payments

Gentle AR recovery that maintains your brand and eliminates cash flow issues requires a modern solution. Try Almaq today.

© Copyright 2024, All Rights Reserved by Almaq, Inc.

Say goodbye to writing off late payments

Gentle AR recovery that maintains your brand and eliminates cash flow issues requires a modern solution. Try Almaq today.

© Copyright 2024, All Rights Reserved by Almaq, Inc.